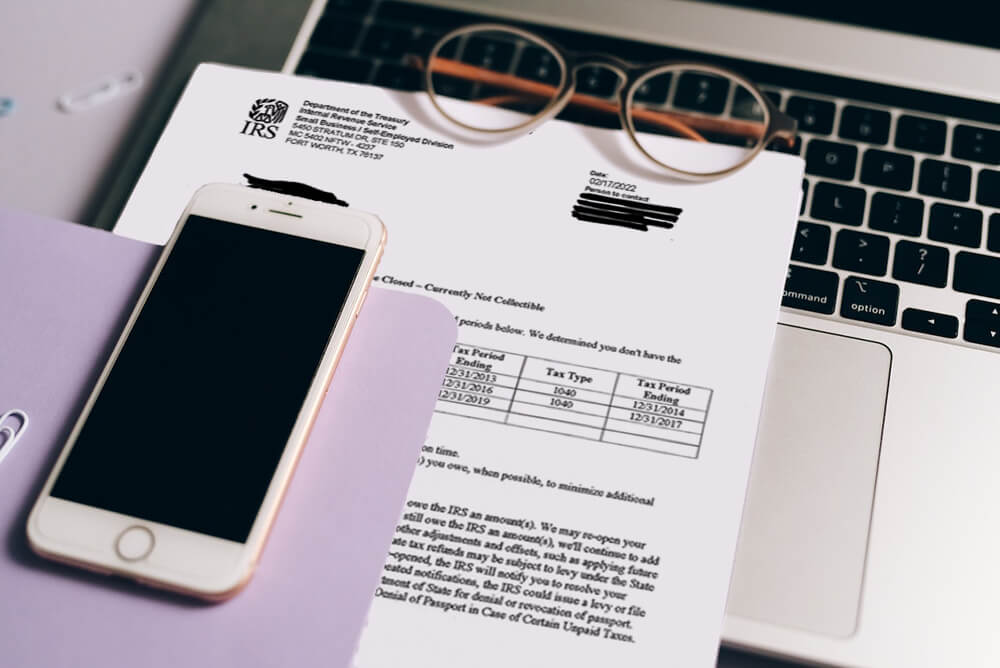

Achieve Peace of Mind with Our Currently Not Collectible (CNC) Status Assistance Today

Facing financial hardships? The IRS can provide a reprieve. Let us help you secure a Currently Not Collectible status and bring calm to your financial storm.

Secure Your CNC Status NowCNC Status Assistance

Navigating Financial Struggles in Taxing Times.

Life can throw unexpected financial challenges, making it hard to meet tax obligations. For some, these obligations become an insurmountable mountain. The IRS recognizes this and can designate a taxpayer’s account as Currently Not Collectible (CNC) if they determine that collection would cause undue hardship. Achieving this status provides temporary relief, but the process can be daunting.

Breathe Easier with Our CNC Status Assistance

Get Assistance

Tax Relief Systems

Expert CNC Status Assistance

We understand the overwhelming burden that comes with the inability to pay your tax bills. With Tax Relief Systems, our team of tax experts is here to help guide and assist you in securing your CNC status. We will work with you to ensure that the IRS recognizes your financial hardship and provide you with the much-needed breathing space to help alleviate the stress.al Turmoil.

We know the emotional and financial stress of not being able to pay your tax bills. Our team of tax experts at Tax Relief Systems is here to guide and assist you in securing your CNC status. We’ll ensure the IRS recognizes your financial hardship, offering you the breathing space you need.

Defend Against Overwhelming Tax Demands

The IRS can be persistent in its collection efforts, but with CNC status, IRS efforts can be paused. Our team will work tirelessly to prove that any collection action would cause you financial hardship, giving you the time to rebuild.

IRS Financial Analyses Specialists

The process to secure CNC status involves rigorous financial analysis by the IRS. We’ll help you prepare and present your financial information effectively, ensuring you meet the criteria for this crucial relief status.

The Temporary Relief of CNC Status with the IRS

Though CNC provides temporary relief, it’s not a permanent solution. We’ll ensure you understand the intricacies of this status, helping you plan for the future while giving you the present relief you need.

We simplify the process

Steps to Secure Your CNC Status

First, Book Your Free Consultation Today

Initiate a conversation with our skilled tax relief experts.

We’ll Conduct A Detailed Financial Analysis

Together, we’ll gather and analyze your financial information, ensuring a robust case for CNC status exists.

Secure Currently Not Collectable (CNC) Status

With us in your corner, you’ll be able to resolve your current financial hardship and prevent further hardship by obtaining a currently not collectible status on your tax debt.

Let’s Get Started on Your Journey to Relief!

Start Your CNC Process Today!take immediate action

Ease The Financial Strain Of Tax Debt with A CNC Status Filing

Harness the Power of Currently Not Collectable Status Assistance

The key to securing a CNC status lies in timely action and presenting a solid case. We are here to guide you in presenting your financial situation accurately to the IRS. Act today to prevent further financial distress.

Obtaining A CNC Status from the IRS Requires Immediate Action

It’s important to act quickly when it comes to time-sensitive matters. Taking proactive steps now can help you get the relief you need sooner rather than later, resulting in significant financial and emotional benefits.

Get Expert Assistance

Our proactive planning assistance can help prevent future financial distress.

Act Now for a Brighter Financial Tomorrow

Talk to a Tax ExpertWhat may happen

The Risks of Delaying CNC Application And Avoiding The Potential Pitfalls

Unaddressed Tax Debt Can Impact Than You Might Know

Failing to address tax debts can result in more serious problems. This may include incurring penalties or facing legal action. The consequences of not dealing with tax debts in real life can be significant.

Missing Your Opportunity to File A CNC Status Can Cost You Everything

If you delay or ignore your CNC application, it can result in increased financial stress. It’s crucial to take action promptly to achieve this status and experience immediate relief.

Bridging to Permanent Solutions Before IRS Collections Resume Requires Tax Relief Systems

CNC is a temporary status that puts a halt on collections by the IRS. However, it is important to note that the IRS can and will resume collections once your financial situation improves. Understanding when and how this may happen is crucial to avoid any unexpected surprises.

Securing CNC Status

Peace in the Midst of Financial Storms: Triumphs in Securing CNC Status

Success Stories: Relieved Taxpayers Share Their Experiences

Discover the stories of those who once faced overwhelming tax obligations but found relief through the CNC status. Their journey with TRS highlights hope and shows that financial storms can be weathered with the right guidance.

Give Yourself Relief and Time to Recover From Financial Hardships

The relief of achieving CNC status is profound. It’s not just about halting IRS collections; it’s about the peace of mind that comes from knowing you have time to rebuild. With CNC status in place, you can focus on improving your financial health without the looming threat of IRS collections.

Start Your Journey to ReliefCNC Status FAQ

Your Questions, Answered

When dealing with the Currently Not Collectible (CNC) Status process, we recognize the significance of providing straightforward and succinct details. We have gathered a selection of commonly posed inquiries along with their corresponding responses to furnish you with the necessary information.

Currently Not Collectible status is when the IRS determines that collecting from a taxpayer would cause undue hardship. The taxpayer’s account is temporarily suspended from collection actions.

CNC status is temporary, usually lasting until the taxpayer’s financial situation improves. However, the IRS will re-evaluate the taxpayer’s situation periodically.

While CNC halts collections, it doesn’t forgive the debt. Interest and penalties may still accrue.

Qualification is based on a thorough financial analysis by the IRS, determining that collection actions would result in financial hardship.

While collections are halted, the IRS will continue to assess your financial situation. If they determine an improvement in your financial status, collections may resume.

It’s possible, but each case is unique. Consult with tax professionals, like TRS, to determine the best approach for your situation.

Still have questions? Reach out to our experts.