Have you ever wondered if you can deduct your tax attorney fees on your taxes? It’s a question that many taxpayers face when filing their taxes, and the answer can be complicated. Knowing whether or not your tax attorney fees are deductible is an important consideration as it could potentially save you money. In this article, we’ll discuss the ins and outs of deducting tax attorney fees from your taxes and how to make sure you get it right.

The rules surrounding the deduction of tax attorney fees can be confusing, and there are many factors to consider. Fortunately, understanding the basics of this deduction can help make it easier for taxpayers to know when they are eligible for a deduction. We will go over what types of services qualify for a deduction, which expenses are not deductible, and how to claim any deductions that you may be eligible for on your taxes.

Taxes can be complicated enough without having to worry about whether or not your tax attorney fees will qualify for a deduction. With the right information, however, you can easily determine whether or not you’re eligible for this deduction and take advantage of any savings available to you. Let’s dive in and explore everything there is to know about deducting tax attorney fees on your taxes!

Understanding Tax Laws

Tax laws can be complicated and hard to understand. When it comes to determining whether or not tax attorney fees are deductible, it’s essential to have a thorough understanding of the relevant rules and regulations. It’s important to bear in mind that many tax deductions are subject to limitations and restrictions, depending on a person’s individual circumstances.

It’s also important to note that in order for any tax deduction to be allowed, the expense must meet certain requirements set out by the IRS. Generally speaking, professional fees such as those paid for tax consulting or legal advice will qualify as deductible expenses if they’re related to managing one’s investments or helping with filing taxes. However, this does not necessarily mean that all attorney fees are automatically tax-deductible.

The key factor when deciding if an attorney fee is deductible is whether the fee was incurred in connection with producing taxable income or attempting to reduce a taxpayer’s liability. If so, then the fee may be eligible for deduction; however, it’s best to consult a qualified accountant or tax attorney before claiming any deductions related to attorney fees on one’s taxes.

Professional Services

Professional services, such as those of a tax attorney, can be an invaluable aid when it comes to filing taxes. Many times these services come with fees attached. The question then arises: are these fees deductible?

The answer is yes, in certain circumstances. Fees paid for the preparation of individual income taxes or for representation before the IRS may qualify for a deduction. However, any fees associated with other types of legal services that don’t relate to preparing or filing taxes are not deductible. This includes items like estate planning and asset protection, which do not qualify for a deduction.

When considering whether or not to take this deduction, it’s important to weigh the potential benefits against the potential risks. Taking a deduction might have certain advantages but it could also result in an audit by the IRS if they feel the amount claimed is excessive. It’s best to consult with a qualified tax professional who can help provide advice on how to properly claim any deductions related to professional services.

Consulting Fees

Consulting fees can include services such as legal advice, tax preparation, and accounting services. Here is a list of what you should know:

- Consulting fees are generally deductible as long as the service being provided is necessary for the production of your income.

- The fee must be reasonable and documented with receipts or invoices in order to be deductible.

- Certain types of consulting fees may be excluded from deductibility due to restrictions or limitations set by the IRS.

- You must keep records of any consulting fees paid throughout the year to ensure proper deduction on your taxes.

It’s important to speak with an experienced tax professional regarding any questions you may have about deducting consulting fees on your taxes before submitting them to the IRS. This will ensure that all deductions are taken correctly and will help prevent any potential issues with your taxes down the road.

Legal Expenses

In the U.S., legal expenses are generally deductible as long as they are incurred in the production or collection of taxable income. Tax attorney fees specifically can be claimed as a deduction if they relate to the taxpayer’s preparation, presentation, and defense of any return, claim for refund, or other document filed with the Internal Revenue Service (IRS). The IRS considers such fees to be part of investment costs since they are related to maintaining or increasing one’s net income.

Any tax attorney fees related to personal matters that do not involve taxes or income generation should not be deducted. For example, a fee paid to an attorney for services rendered in a divorce proceeding would not be considered deductible since it does not generate taxable income.

Taxpayers must itemize their deductions in order to claim attorney fees. Itemized deductions should also include any court costs and related expenses associated with the legal service purchased. Be sure to keep all receipts and/or invoices related to legal expenses so that you can support your claims when filing taxes each year.

Tax Preparation Services

Taxpayers may be able to deduct attorney fees paid for advice and assistance related to preparing or filing their tax return. This includes fees for researching and preparing an amended return or a refund claim. Additionally, taxpayers may also deduct certain other legal expenses related to their taxes, such as court costs and fees for representing them in a tax audit or dispute.

When considering whether to deduct attorney fees on a tax return, it’s important to understand which types of expenditures are considered legitimate deductions by the IRS. Generally, only those expenses related directly to preparation of a specific year’s tax return can be deducted. Any legal services not connected with the taxpayer’s taxes cannot be claimed as deductions. It’s also important to keep all receipts and invoices from any attorneys hired in order to have proof of payment if needed when filing taxes.

It should be noted that while some attorneys may specialize in tax matters and provide advice on minimizing taxes, these services are typically not deductible because they are considered personal investments rather than necessary business expenses. However, if an individual has received a penalty or assessment when filing their taxes due to incorrect information or late payment of taxes, they may be eligible for an abatement if they have consulted with a qualified professional who has provided accurate advice on how to avoid this situation in the future.

IRS Representation

Yes, tax attorney fees are deductible in certain cases. In order to be deductible, the expenses must relate directly to the taxpayer’s job or investments. This includes costs associated with seeking legal advice from an attorney regarding federal and state tax matters. If a taxpayer is being audited by the IRS, they may need to hire a tax attorney to represent them. The expense of engaging and paying for a legal professional is considered a business cost and may be deducted on the taxpayer’s Schedule A form.

When hiring a tax lawyer, taxpayers should consider their experience level and whether they specialize in the applicable laws and regulations. It’s also important to find out if they are familiar with the internal procedures of the IRS so that they can best advocate on behalf of their client. Furthermore, taxpayers should ask about potential fees or charges before agreeing to work with any particular lawyer.

Taxpayers should also make sure that their chosen attorney has sufficient knowledge of their specific situation; this will help them find strategies that can save time, money and frustration down the line. Consulting with an experienced lawyer can provide peace of mind knowing that your taxes are being handled correctly.

Determining Deductibility Of Fees

In order to determine whether or not tax attorney fees are deductible, it is important to consider several factors. First, you must look at the purpose of the fees. The fees must be related to a deductible item on your tax return in order for them to be deductible. Additionally, the fees must have been paid for services that are related to producing taxable income. They cannot be used for personal reasons, such as estate planning or filing taxes late.

Another important factor to consider is if the legal services were rendered while performing your job duties as an employee or while running a business. If so, then the fees may be deductible as a business expense. Additionally, legal fees related to collecting taxable income can also be deducted. For example, if you receive alimony payments and need help filing your taxes, then that might qualify as a deduction.

Finally, it is important to keep accurate records of all expenses related to the legal fees in order to properly document them when filing taxes. This will ensure that deductions are correctly applied and that any necessary paperwork is filed correctly with the IRS. Keeping organized records will make it easier to accurately file taxes each year and maximize deductions where possible.

Documentation Requirements For Deductions

Documentation is a critical part of claiming deductions on tax attorney fees. To be eligible for the deduction, taxpayers must provide an itemized bill from their attorney, which includes their name and Social Security number or other taxpayer identification number. Additionally, the bill must include the dates of service, description of services, and any payments made to the attorney. Taxpayers should also keep supporting documents such as contracts, invoices, and receipts that demonstrate payment for all legal services rendered.

In addition to providing documentation for tax-deductible items, taxpayers should make sure they have sufficient records to back up the expenses they are deducting. This means keeping bank statements showing payments made to an attorney as well as copies of any checks sent in payment. Taxpayers should also retain canceled checks or credit card statements related to the legal fees incurred.

All of this information should be gathered and kept with your other financial records in case you need to show proof of these deductions during an audit by the IRS. It’s important to understand that if you do not have adequate documentation for your expenses then you may not be able to claim a deduction on your taxes at all.

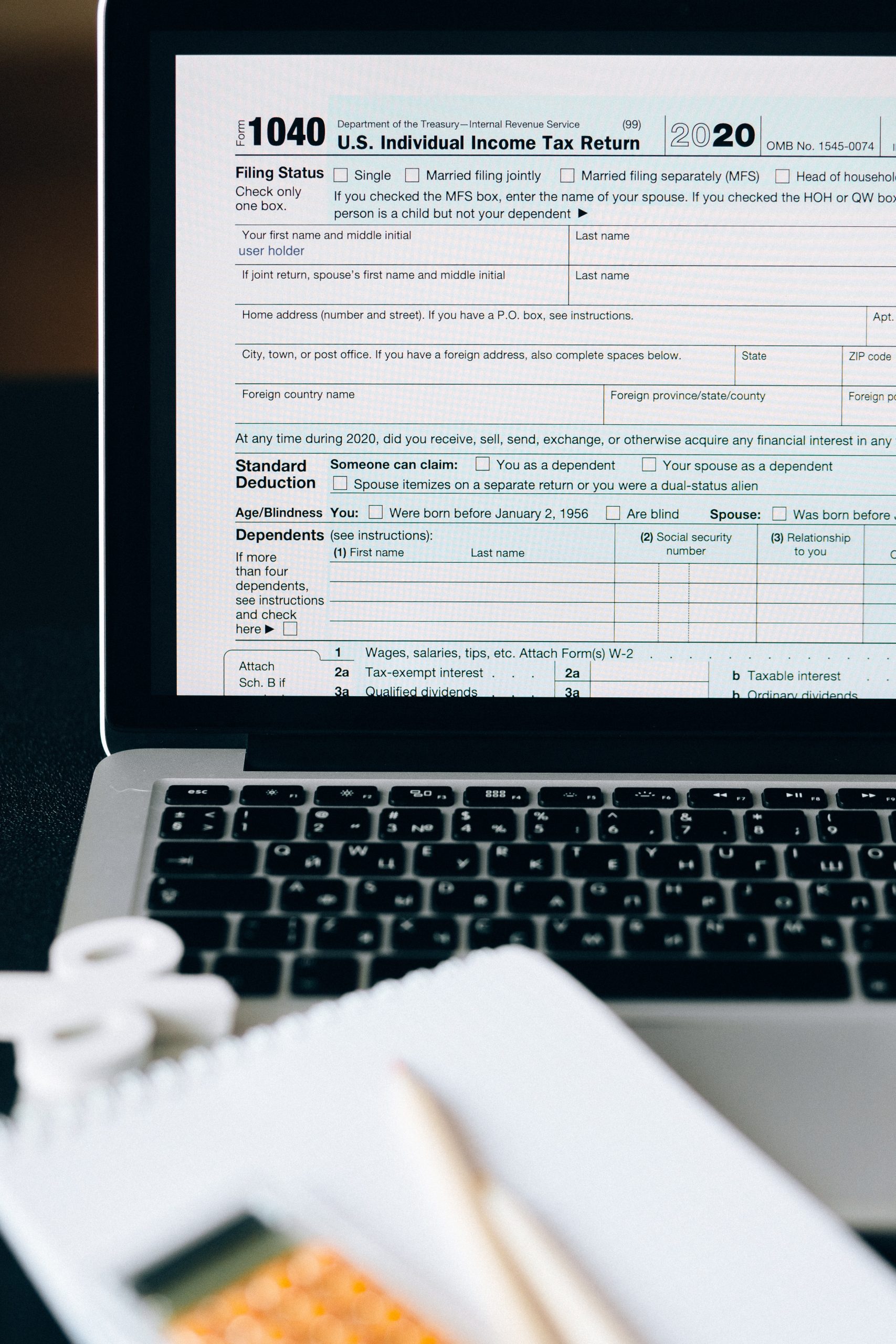

Reporting Attorney Fees On 1040 Form

The Internal Revenue Service (IRS) allows taxpayers to deduct certain professional fees on their 1040 Form. This includes fees paid for tax attorneys. The deduction for these fees is listed as an itemized expense on Schedule A of the 1040 Form.

When reporting attorney fees on a 1040 Form, it’s important to keep in mind that the IRS imposes specific rules and restrictions for what is and isn’t deductible. Any legal expenses related to producing taxable income are not deductible. Examples include attorney fees for estate planning or setting up a business entity. Legal expenses incurred from defending a taxpayer in criminal court or filing a personal injury lawsuit also cannot be deducted.

However, attorney fees related to filing taxes, dealing with tax issues, and preparing returns are generally deductible expenses. Deductible costs may include lawyer consultations, research costs, court filing fees, and other related costs associated with legal representation in matters of taxation law. Taxpayers should keep detailed records of all deductions claimed so they can provide the necessary documentation if audited by the IRS.

Special Considerations For Businesses

It is important to note that businesses may also have different rules when it comes to deducting tax attorney fees. Businesses may qualify for deductions related to their professional activities, including those incurred to protect their interests, such as legal fees.

The following points should be considered before claiming a deduction on business taxes:

-Claiming a deduction requires the taxpayer to keep detailed records of the expenses and services provided by the tax attorney.

-This includes not only the amount paid but also what was received in return, such as a written opinion or consultation on a specific issue.

-The fee must be ordinary and necessary for any business activity, meaning that it relates specifically to the company’s operations and not for any personal reasons.

-For example, if the fee was incurred due to an audit conducted by the IRS or by another state agency, then it would be considered deductible.

-The deduction must be reasonable in relation to other similar services offered in the same industry or geographic area.

-For instance, if other businesses are paying significantly lower rates for similar services, then this could affect whether or not a deduction is allowed.

When considering these special considerations for businesses regarding tax attorney fees, it is essential to consult with an experienced professional who can provide guidance on whether or not such deductions are appropriate and allowable under current regulations.

Impact On State And Local Taxes

In most cases, tax attorney fees are not deductible from state and local taxes. However, in some cases, an attorney may be able to provide services that could impact the taxpayer’s state or local taxes. These services could include filing a return or providing advice on the best way to file for a refund. In these situations, taxpayers should consult their attorney about whether any portion of the fee is deductible when filing state or local taxes.

It is important to remember that each situation is unique and should be evaluated on its own merits before deductions can be applied. Taxpayers should also take into account any other applicable credits and deductions available to them under their specific circumstances. Additionally, they should ensure that they are aware of any potential penalties if they fail to accurately report their expenses on their tax returns.

Taxpayers should always consult an experienced tax professional before making any decisions regarding those fees that may be deductible from their state or local taxes. This will help them ensure they understand the consequences of taking any action and make sure they receive all applicable benefits from their deduction.

IRS Audits And Penalties

If a taxpayer’s return is selected for examination, they will likely incur legal fees in order to ensure that their interests are properly represented. Fortunately, many of these taxes attorney fees can be claimed as a deduction on the taxpayer’s next tax return.

When facing an IRS audit, it is important to remember that taxpayers have certain rights and protections under federal law. Taxpayers have the right to representation by an attorney or a qualified representative of their choice and are also entitled to receive written notice informing them of any changes made to their return and why they were made. In addition, taxpayers may also request appeals when disputing adjustments proposed by the IRS.

Taxpayers should also be aware of any potential penalties imposed by the IRS for non-compliance with tax laws. Penalties may include failure-to-file, failure-to-pay, accuracy-related penalties, and other civil or criminal penalties depending on the severity of the violation. Understanding one’s rights and liabilities is essential in order to minimize any potential repercussions from an audit or penalty situation.

Contact Tax Relief Systems

Understanding the tax laws can be complex and it is important to consult with a qualified tax professional to determine the best course of action when considering legal expenses or tax preparation services.

Reach out to the qualified professionals at Tax Relief Systems today for a free consultation. You are not alone.