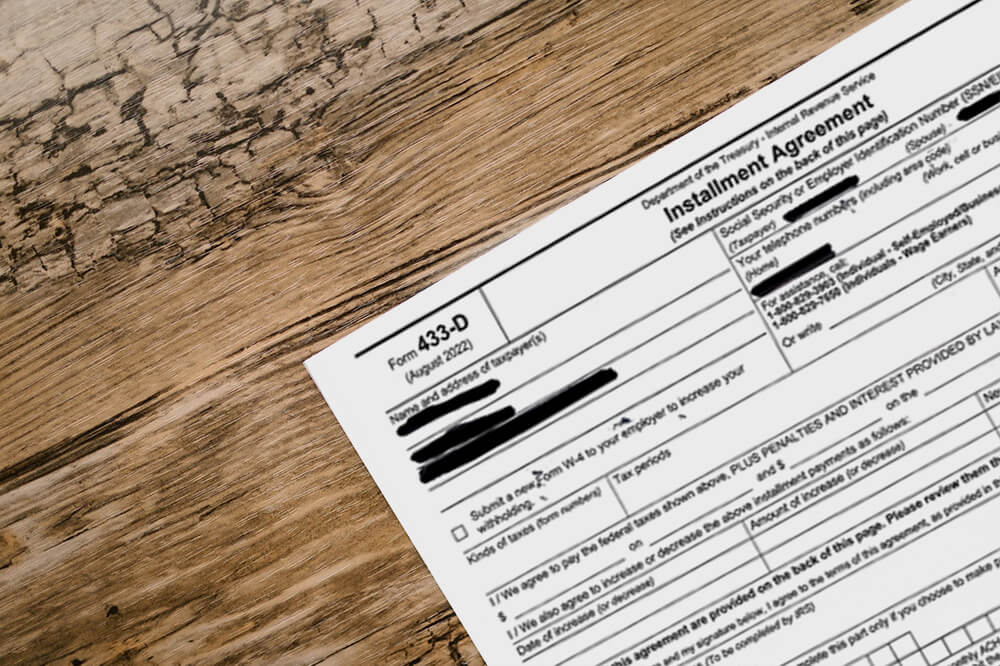

Secure Your IRS Installment Agreement and Regain Financial Stability

Don’t let unpaid taxes dictate your financial future. With Tax Relief Systems, you can set up an IRS installment agreement that allows you to pay your tax debts over time, ensuring peace of mind and financial freedom.

Secure a Payment PlanTax Burden Relief

The Challenges of Unpaid Taxes and the Need for an IRS Installment Agreement

Unpaid taxes can quickly become a significant burden, leading to financial strain and emotional stress. But with an IRS installment agreement, you can spread out your payments and manage your debts more effectively.

The Growing Debt from Unpaid Taxes

Every day without an IRS installment agreement means accumulating interest and penalties on your unpaid taxes. This can turn a small debt into a significant financial challenge.

The Emotional Weight of Tax Debts

Beyond the financial strain, the constant worry about unpaid taxes and potential IRS actions can take a toll on your mental well-being.

Celebrating a Debt-Free Future with Confidence

The ultimate goal of an IRS Installment Agreement is to provide you with a clear path to a debt-free future. With the guidance and support of Tax Relief Systems, you can look forward to the day when your tax debts are fully settled, allowing you to celebrate financial freedom with confidence.

Tax Relief Systems

Your Expert in IRS Installment Agreements

Our team specializes in IRS installment agreements, ensuring you get a payment plan that’s both fair and manageable.

Personalized IRS Installment Plans:

We assess your financial situation to set up an installment agreement with the IRS that aligns with your ability to pay.

Expert IRS Negotiations:

Our experience with IRS installment agreements means we know how to negotiate the best terms for you.

A Comprehensive Approach:

Beyond just setting up an installment agreement with the IRS, we provide guidance to help you maintain financial stability in the future.

PATH TO FINANCIAL CLARITY

Our Methodical Approach to Securing Your IRS Installment Agreement

Detailed Financial Analysis

Understand your financial standing to determine the best monthly payment for your IRS installment agreement.

Strategic IRS Negotiation

Use our expertise to negotiate favorable terms for your installment agreement.

Finalize Your IRS Installment Agreement

Experience the relief of a structured IRS payment plan, putting you on the path to clearing your tax debts.

Act Now: Set Up Your IRS Installment Agreement

Don’t let tax debts control your life. Take action today and secure an IRS installment agreement to spread out your payments and regain financial stability.

Get Started TodayTax Repayment Mastery

Navigating the Pitfalls of Tax Debt with an IRS Installment Agreement

Discover the art of tax repayment, avoiding pitfalls while learning from others. Unveil consequences of neglecting tax debts and embrace the protective power of IRS Installment Agreements for financial stability.

Get Audit HelpAvoiding Common Mistakes in Tax Repayment

Many individuals, when faced with tax debts, make the mistake of either ignoring the problem or opting for quick-fix solutions that don’t address the root issue. By choosing an IRS Installment Agreement through Tax Relief Systems, you’re taking a proactive approach, ensuring that you’re not just putting a band-aid on a growing financial wound.

The Consequences of Ignoring Tax Debts

Ignoring tax debts can lead to severe repercussions, including wage garnishments, liens on property, and even legal action. The longer the debt remains unpaid, the more penalties and interest accrue, making the situation even more challenging to resolve. An Installment Agreement acts as a buffer, preventing these severe consequences and giving you the breathing room to repay your debts systematically.

How an IRS Installment Agreement Prevents Financial Downfalls

An IRS Installment Agreement is more than just a repayment plan; it’s a strategic approach to managing and eliminating tax debt. By breaking down your debt into manageable monthly payments, you’re not only ensuring compliance with the IRS but also safeguarding your financial future from potential downfalls.

Freedom over time

Achieving Financial Freedom with a Structured IRS Installment Plan

The Long-Term Benefits of Timely Tax Repayments

Timely tax repayments not only free you from the immediate burden of debt but also pave the way for long-term financial benefits. Consistent payments improve your standing with the IRS, reduce the risk of future tax issues, and can even positively impact your credit score over time.

Rebuilding Financial Credibility with the IRS

Every payment made under your Installment Agreement is a step towards rebuilding trust and credibility with the IRS. Over time, as you adhere to the terms of your agreement, you’ll find that you’re in a better position to negotiate should any future tax issues arise.

Celebrating a Debt-Free Future with Confidence

The ultimate goal of an IRS Installment Agreement is to provide you with a clear path to a debt-free future. With the guidance and support of Tax Relief Systems, you can look forward to the day when your tax debts are fully settled, allowing you to celebrate financial freedom with confidence.

Empowering Taxpayers

Success Stories with IRS Installment Agreements

Discover inspiring client success stories as they regain financial control through successful IRS Installment Agreements. Real results, real relief.

Clients Who Found Financial Freedom Through Our Expert Negotiations

Read firsthand accounts of individuals who turned their tax burdens around by trusting Tax Relief Systems to negotiate their IRS Installment Agreements. Their journeys from financial stress to relief are a testament to our dedication and expertise.

Installment Agreement FAQ

Understanding IRS Installment Agreements

When it comes to IRS Installment Agreements, we understand the importance of delivering clear and concise information. We have gathered a selection of the most frequently asked questions and their answers to provide you with the necessary information you need.

An Installment Agreement is a monthly payment plan set up with the IRS to help individuals repay their tax debt over time.

The monthly payment amount is based on your ability to pay and your total tax debt.

While the debt is being paid through an Installment Agreement, interest and penalties still accrue on the owed amount.

It’s essential to contact the IRS or your representative at Tax Relief Systems immediately if you foresee difficulties in making a payment. Not addressing this can lead to a default on the agreement.

Still have questions? Reach out to our experts.